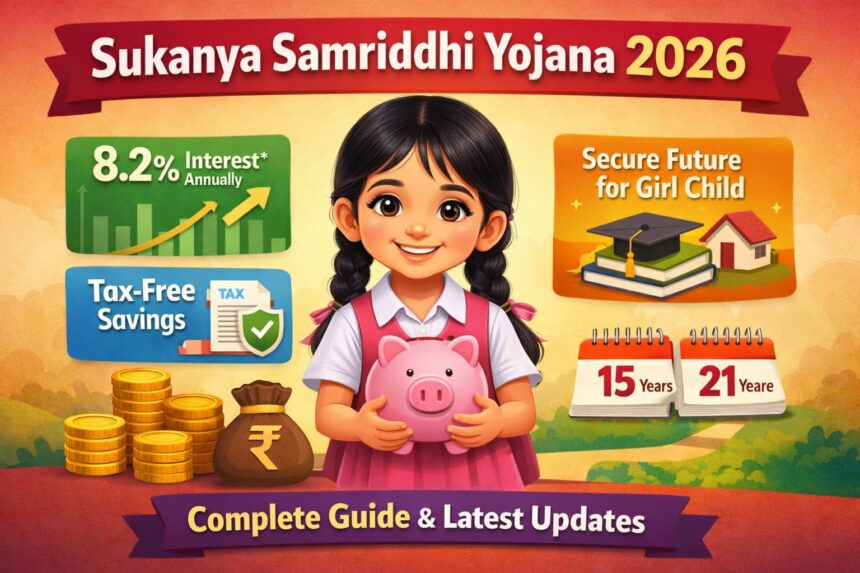

Sukanya Samriddhi Yojana 2026: Complete Guide, Benefits, and Latest Updates

Introduction

Sukanya Samriddhi Yojana (SSY) is one of India’s most trusted savings schemes for the financial security of the girl child. Launched under the Beti Bachao Beti Padhao initiative, SSY offers attractive tax-free returns and long-term financial growth for your child.

- Introduction

- What is Sukanya Samriddhi Yojana (SSY)?

- Sukanya Samriddhi Yojana 2026 Interest Rate

- Eligibility Criteria

- How to Open Sukanya Samriddhi Yojana Account in 2026

- SSY Deposits and Limit

- Maturity and Withdrawal Rules

- Benefits of Sukanya Samriddhi Yojana 2026

- SSY Calculator 2026 – Projected Maturity

- FAQs About Sukanya Samriddhi Yojana 2026

- Final Thoughts

In 2026, the scheme continues to be popular among parents and guardians due to its high-interest rates, tax benefits, and secure government backing.

What is Sukanya Samriddhi Yojana (SSY)?

Sukanya Samriddhi Yojana is a government-backed savings scheme that allows parents or guardians to save for the education and marriage of their girl child.

Key highlights:

- Launched: 2015

- Eligible: Girl child below 10 years

- Deposit Period: 15 years from account opening

- Maturity: 21 years from account opening

- Interest: 8.2% (Q1 2026)

Sukanya Samriddhi Yojana 2026 Interest Rate

The Government of India reviews SSY interest rates quarterly. For 2026:

- Current Interest Rate: 8.2% per annum

- Tax Benefits: Fully tax-free under Section 80C

- Compound Interest: Compounded annually, allowing higher returns over long-term

SSY continues to provide one of the highest safe returns among government-backed savings schemes.

Eligibility Criteria

To open an SSY account:

- The account must be opened in the name of a girl child aged 0–10 years.

- Only one account per child is allowed.

- Maximum two girl children per family are eligible (exceptions apply if first child is a girl).

- Account can be opened by parents or legal guardians.

How to Open Sukanya Samriddhi Yojana Account in 2026

Steps to open SSY account:

- Visit any post office or authorized bank.

- Fill the SSY account opening form.

- Submit birth certificate of the girl child.

- Deposit the minimum initial amount of ₹250.

Online Option: Many banks now allow digital account opening through net banking or mobile apps.

SSY Deposits and Limit

- Minimum Annual Deposit: ₹250

- Maximum Annual Deposit: ₹1.5 lakh

- Deposits can be made anytime during the financial year.

- Contributions are allowed for 15 years from the account opening date.

Partial withdrawal is allowed for higher education of the girl child after she turns 18.

Maturity and Withdrawal Rules

- The SSY account matures after 21 years from opening.

- Partial withdrawal up to 50% is allowed for higher education or marriage after the girl turns 18.

- Tax-Free Maturity: Both principal and interest are completely tax-exempt.

Benefits of Sukanya Samriddhi Yojana 2026

- High Returns: 8.2% interest (risk-free).

- Tax Savings: Eligible under Section 80C.

- Secure Government Scheme: Principal and interest are safe.

- Long-Term Planning: Helps fund education and marriage.

- Flexible Deposits: Pay monthly, quarterly, or yearly.

SSY Calculator 2026 – Projected Maturity

| Annual Deposit | Years | Maturity Amount* |

|---|---|---|

| ₹50,000 | 15 | ₹15,21,000 |

| ₹1,00,000 | 15 | ₹30,42,000 |

| ₹1,50,000 | 15 | ₹45,63,000 |

*Assuming 8.2% compounded annually for 15 years.

Investing early increases compound interest benefits significantly.

FAQs About Sukanya Samriddhi Yojana 2026

Q1. Can SSY account be transferred?

Yes, accounts can be transferred to any bank or post office if you move cities.

Q2. Can a girl child above 10 open SSY?

No, SSY can only be opened for girls below 10 years.

Q3. Is SSY better than PPF?

SSY usually offers higher interest rates than PPF and has tax-free maturity.

Q4. Can parents of a single child open more than one SSY account?

Only one account per girl child is allowed, but if the family has two girls, both can have separate accounts.

Final Thoughts

Sukanya Samriddhi Yojana 2026 is a must-have financial tool for parents and guardians who want to secure their girl child’s future. With 8.2% interest, tax-free maturity, and a government-backed guarantee, it remains one of the most trusted savings schemes in India.

Start early, contribute regularly, and make the most of compounded returns for your daughter’s education and marriage.

SEO Keywords Included:

- Sukanya Samriddhi Yojana 2026

- SSY interest rate 2026

- Sukanya Samriddhi account opening

- SSY maturity benefits

- Best girl child savings scheme