Atal Pension Yojana 2025 – Apply Online, Chart & Download New Subscriber Registration Form PDF

What is Atal Pension Yojana (APY)

- The Atal Pension Yojana (APY) is a pension scheme by the Government of India, aimed at providing a fixed monthly pension after the age of 60 to subscribers from age group 18–40.

- It is administered via the National Pension System (NPS) architecture under the regulatory oversight of PFRDA.

- The scheme guarantees a monthly pension between ₹1,000 and ₹5,000 (depending on contributions and age at entry) from age 60.

Eligibility Criteria

To subscribe to APY, you must satisfy:

- Atal Pension Yojana 2025 – Apply Online, Chart & Download New Subscriber Registration Form PDF

- What is Atal Pension Yojana (APY)

- Eligibility Criteria

- How to Apply Online (2025)

- Method 1: Via eNPS

- Method 2: Via Bank / Net Banking / Mobile Banking

- Eligibility Criteria for Atal Pension Yojana

- How to Apply Offline (Using PDF Form)

- Download Subscriber Registration Form (PDF)

- Contribution Chart / Premium Table (Indicative)

- 📄 New / Official PDFs of Registration / Subscriber Forms

- 📊 Contribution / Premium Chart (2025 / Latest)

| Criterion | Details |

|---|---|

| Age | 18 to 40 years at the time of joining |

| Bank/Post Office Account | Must hold a valid savings bank account or post office savings account |

| Aadhaar / KYC | The applicant should ideally link Aadhaar and mobile number; KYC needs to be completed as required |

| One APY account only | Each individual is allowed only one APY account |

| Contribution period | You must contribute until you reach 60 years of age |

If any of the criteria is not met, the registration may be rejected or you may not be eligible.

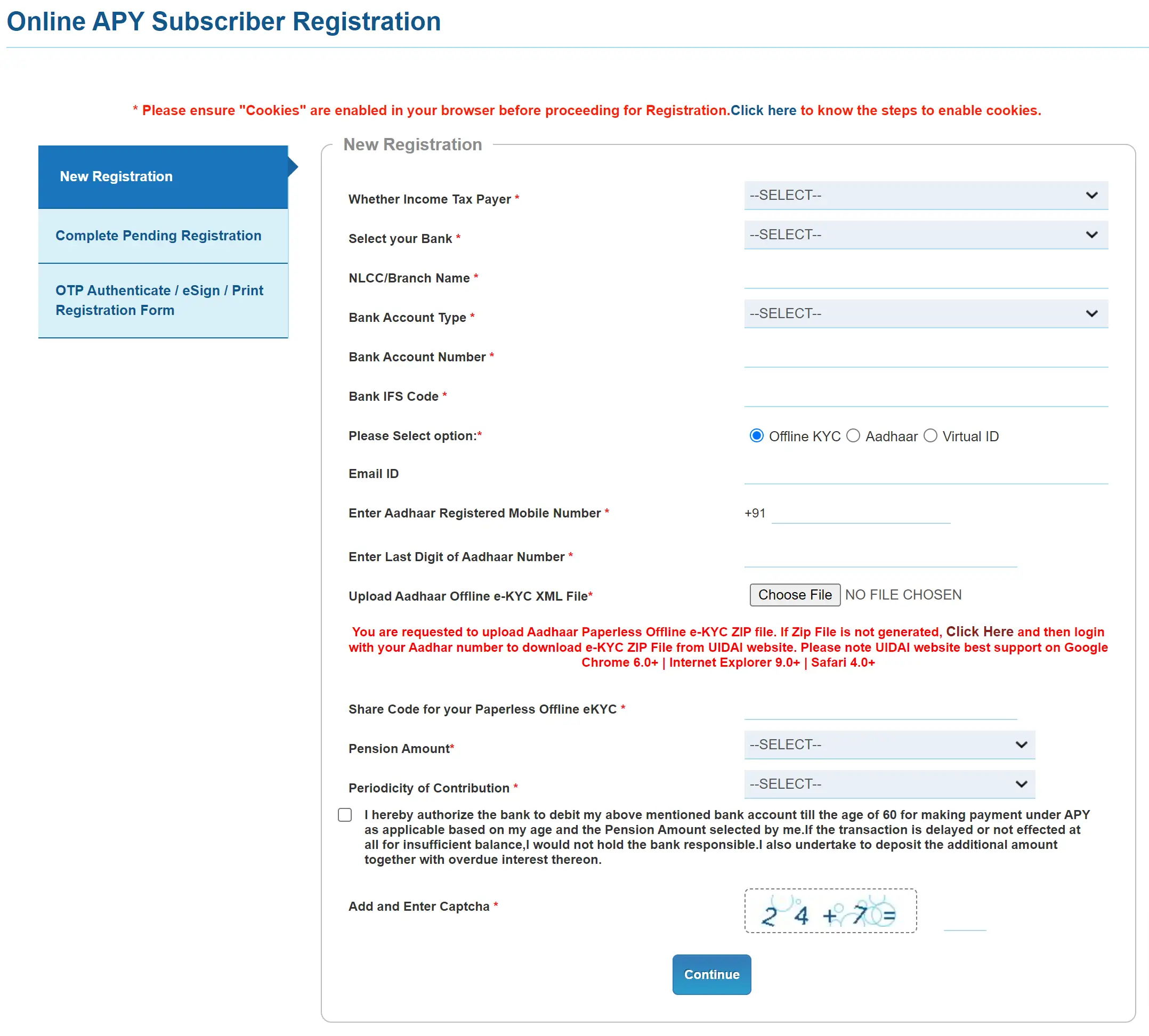

How to Apply Online (2025)

You can open an APY account online through the eNPS portal or via your bank’s net banking interface.

Method 1: Via eNPS

- Visit the eNPS / eNPS-APY registration page. (Protean eGov Technologies)

- Choose “APY Subscriber Registration / New Registration”. (Protean eGov Technologies)

- Provide mandatory details: bank account number, IFSC code, Aadhaar number, email, mobile number (as per Aadhaar).

- Complete KYC and authentication steps.

- Once processed, you’ll receive confirmation / PRAN (Permanent Retirement Account Number) etc.

Note: The CRA (Central Recordkeeping Agency) has recently migrated, so make sure you access the updated portal.

Method 2: Via Bank / Net Banking / Mobile Banking

- Many banks offer an “Apply for APY / Enroll APY” option in net banking or mobile app.

- Log into your bank account → look under “Investments / Social Security / Pension schemes” → choose APY → fill the form → OTP / authentication → submit.

- The contribution will be auto-debited from your account as per frequency (monthly, quarterly, half-yearly) until you turn 60.

Eligibility Criteria for Atal Pension Yojana

To join APY, you must be an Indian citizen aged 18 to 40 years, have a savings bank or post office account, and must not be an income tax payer on or after 1 October 2022. If later it is found that you were an income tax payer before applying, your APY account will be closed and you will get back the accumulated amount.

You can choose any pension slab from Rs 1,000 to Rs 5,000 and pay monthly as per the chart. You can also increase or decrease the chosen pension once in a year using the official process.

How to Apply Offline (Using PDF Form)

You can also enroll in APY by submitting a physical registration form at your bank branch or post office.

- Download the Subscriber Registration Form (PDF)

- Official APY Subscriber Registration Form (NPScra) PDF: (npscra.nsdl.co.in)

- Alternate PDF from other sources: (d3sdkw7nvdnqts.cloudfront.net)

- For post office accounts: post office version of APY registration form PDF (jansuraksha.gov.in)

- Fill the Form

Typical form fields include:- Bank account details (account number, bank name, branch, IFSC)

- Personal details (name, date of birth, age, mobile, email, Aadhaar)

- Spouse name, nominee details (if applicable)

- Pension amount choice, and periodicity (monthly, quarterly, half yearly)

- Declaration and authorization to auto-debit your account until age 60.

- Submit the Form

Submit the filled form along with any required supporting documents (KYC, identity, address proofs, Aadhaar) to the branch or post office. You’ll get an acknowledgment from the bank/post office. (

Download Subscriber Registration Form (PDF)

You can download the APY registration form from these official sources:

- NPScra / NPS CRA site — APY Subscriber Registration Form PDF

- Post Office version — APY registration form (for post office savings accounts) PDF

- State bank / bank PDF templates — many banks provide their version of the APY application form (e.g. Bank of Maharashtra)

You can download and print these, fill them in, and submit them to your bank or post office.

Contribution Chart / Premium Table (Indicative)

Your contribution depends on:

- Your age at entry

- The pension amount you have chosen (₹1,000, ₹2,000, ₹3,000, ₹4,000 or ₹5,000)

- The periodicity (monthly, quarterly, half-yearly)

For example, to get ₹1,000 monthly pension, the approximate monthly contributions (for different entry ages) are:

| Age at Entry | Contribution Period (Years) | Approx. Monthly Contribution* |

|---|---|---|

| 18 | ~42 years | ~₹ 42 (HDFC Bank) |

| 25 | ~35 years | ~₹ 76 (HDFC Bank) |

| 30 | ~30 years | ~₹ 116 (HDFC Bank) |

| 35 | ~25 years | ~₹ 181 (HDFC Bank) |

| 40 | ~20 years | ~₹ 291 (HDFC Bank) |

* These are indicative for ₹1,000 pension; higher pension amounts will require proportionally higher contributions.

Banks or official calculators can give you the exact contribution amount for your desired pension and age.

Here are updated links and sample charts / forms for Atal Pension Yojana (APY):

📄 New / Official PDFs of Registration / Subscriber Forms

- Subscriber Registration Form (All Citizen / NPS) — Ver. 1.5 (CRA / NPScra)

- Subscriber Registration Form (Private Sector) — Ver. 2.3

- Central Bank of India – Registration Form (NPS / linked)

- SBI NPS Editable Form (for NPS / linked schemes) (

You can use the above forms (especially the NPScra ones) when submitting at your bank or branch.

📊 Contribution / Premium Chart (2025 / Latest)

- The NPScra site provides a Subscribers’ Contribution Chart (age-wise, pension slab-wise) in PDF form.

- For example, for a pension of ₹1,000/month, some indicative monthly contributions by entry age are:

Age at Entry Years of Contribution Approx Monthly Contribution 18 42 ₹ 42 (HDFC Bank) 20 40 ~₹ 50 (Digit Insurance) 25 35 ~₹ 76 (Policybazaar) 30 30 ~₹ 116 (HDFC Bank) 35 25 ~₹ 181 (HDFC Bank) 40 20 ~₹ 291 (HDFC Bank) - For higher pension slabs (₹2,000, ₹3,000, etc.), the contributions scale up. For example, to get ₹2,000/month, your monthly contribution can range from ~₹ 84 to ~₹ 528 depending on entry age. (

- A full “Contribution Chart” covering monthly / quarterly / half-yearly frequencies and all pension slabs is provided in the NPScra PDF chart.

You can download that “Subscribers’ Contribution Chart” PDF from the NPScra site.